1099 Form 21 Printable for reporting income Fill out Form 1099 electronically or download the printable PDF as well as in online fillable Schedule C 1099 MISC Form – In general, any organization which has paid at least $600 to some individual or any unincorporated business that has received at least two payment amounts from that person or business must issue a 1099 Form to every individual or business who has obtained at least one of those payment quantities This form is used by the IRS to make sureData, put and ask for legallybinding digital signatures Work from any gadget and share docs by email or fax Try now?

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

How to get a 1099 c form

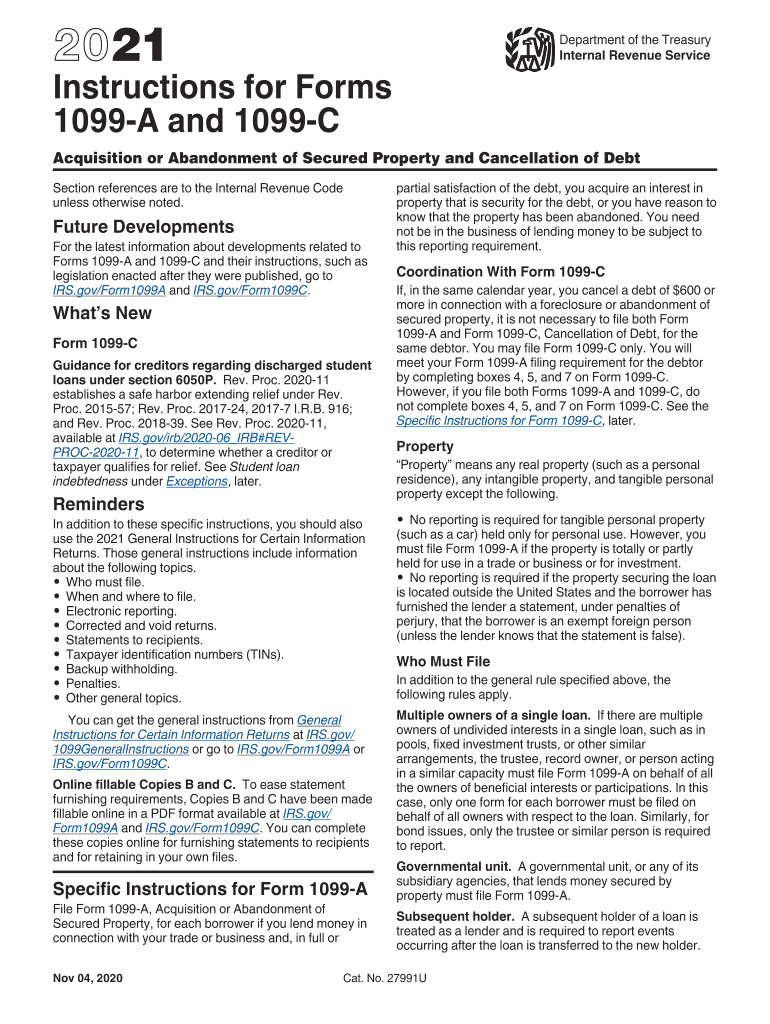

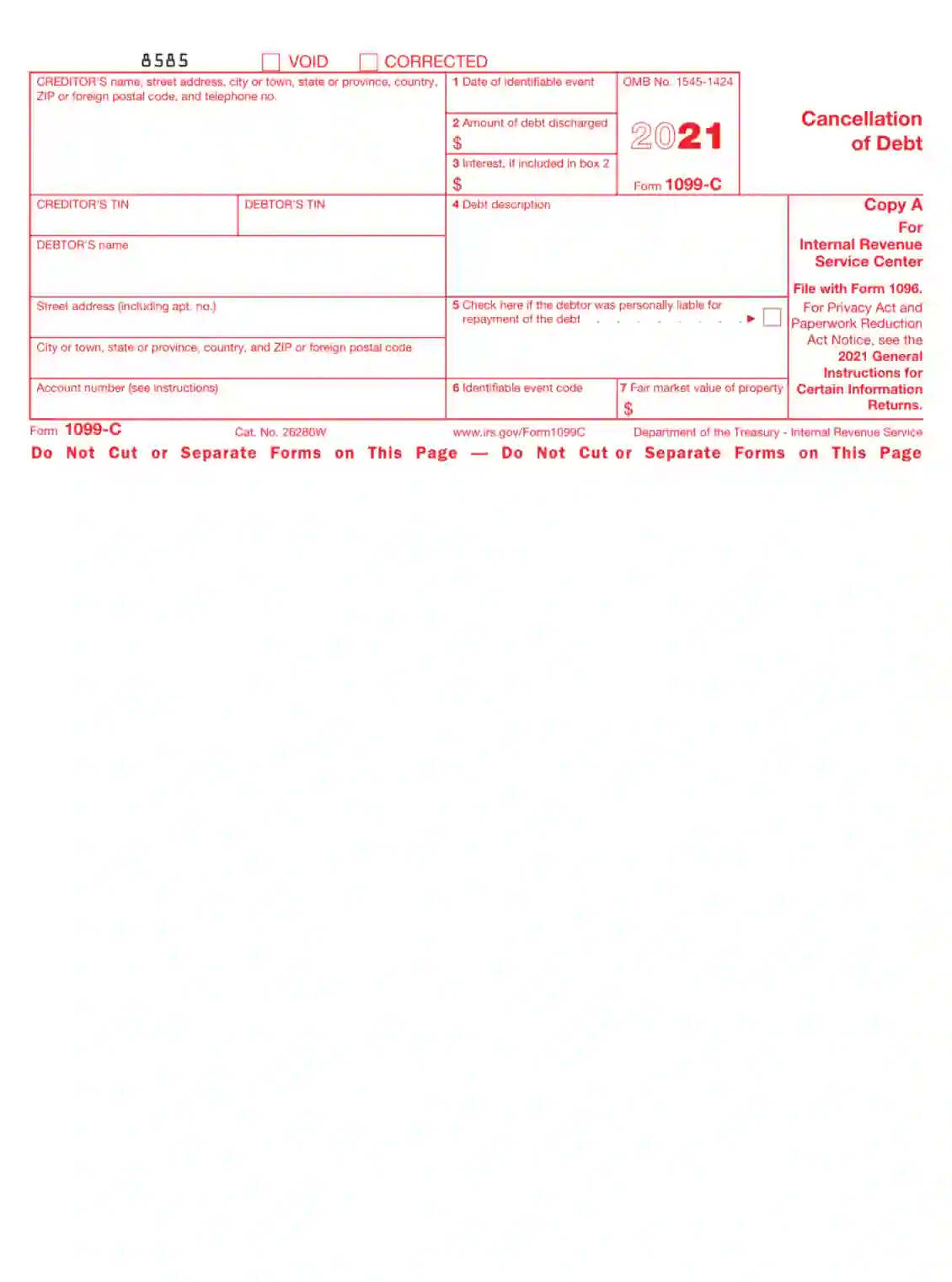

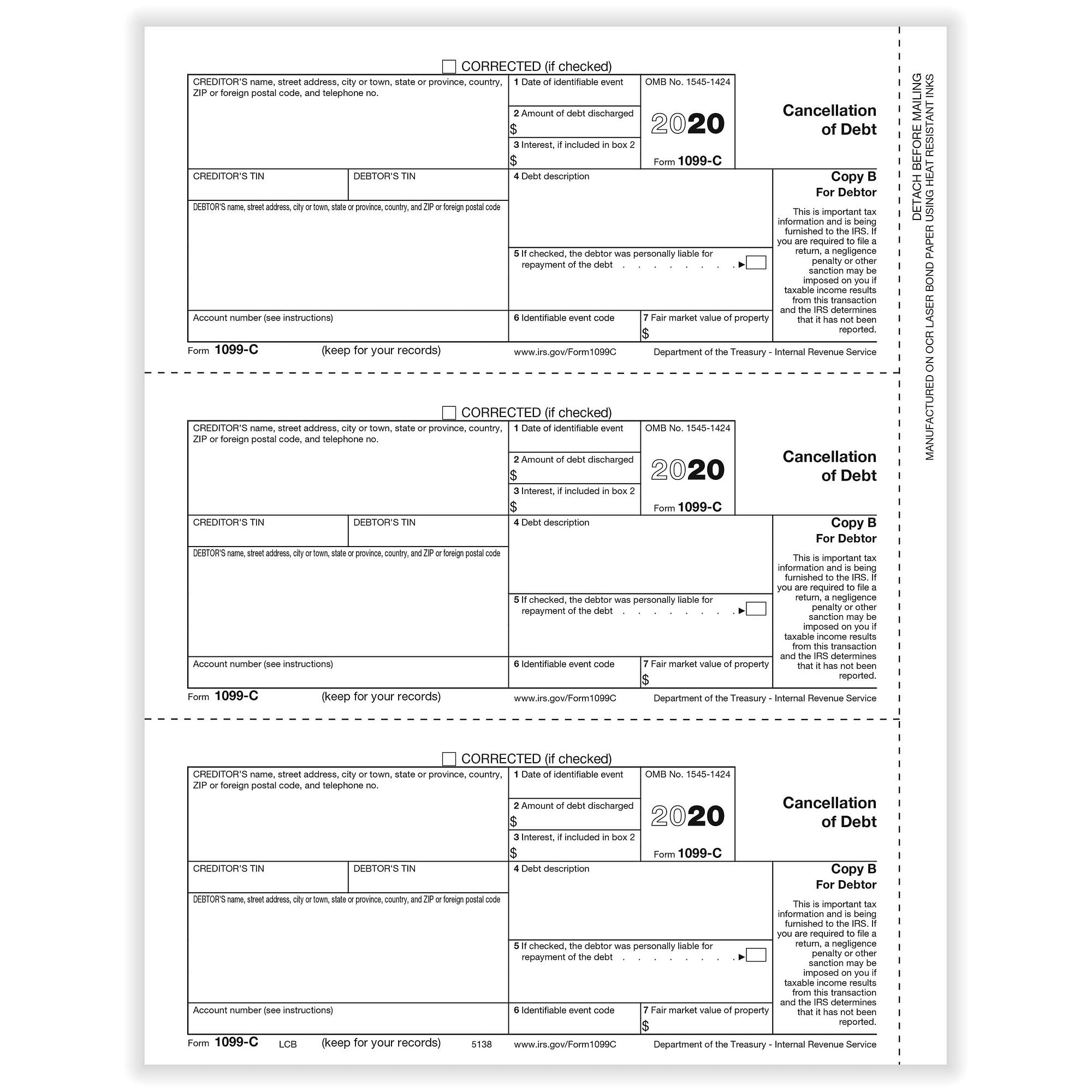

How to get a 1099 c form-Das Formular 1099C (Internal Revenue Service), Forderungsstorno, wird an Schuldner bestimmter qualifizierter Gläubiger gesendet, die während des Steuerjahres Schulden für sie storniert haben Im Allgemeinen müssen Steuerpflichtige, die das Formular 1099C erhalten, den Betrag der stornierten Schulden als Einkommen in ihrer individuellen Einkommensteuererklärung für das Jahr angeben,Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt Inst 1099A and 1099C

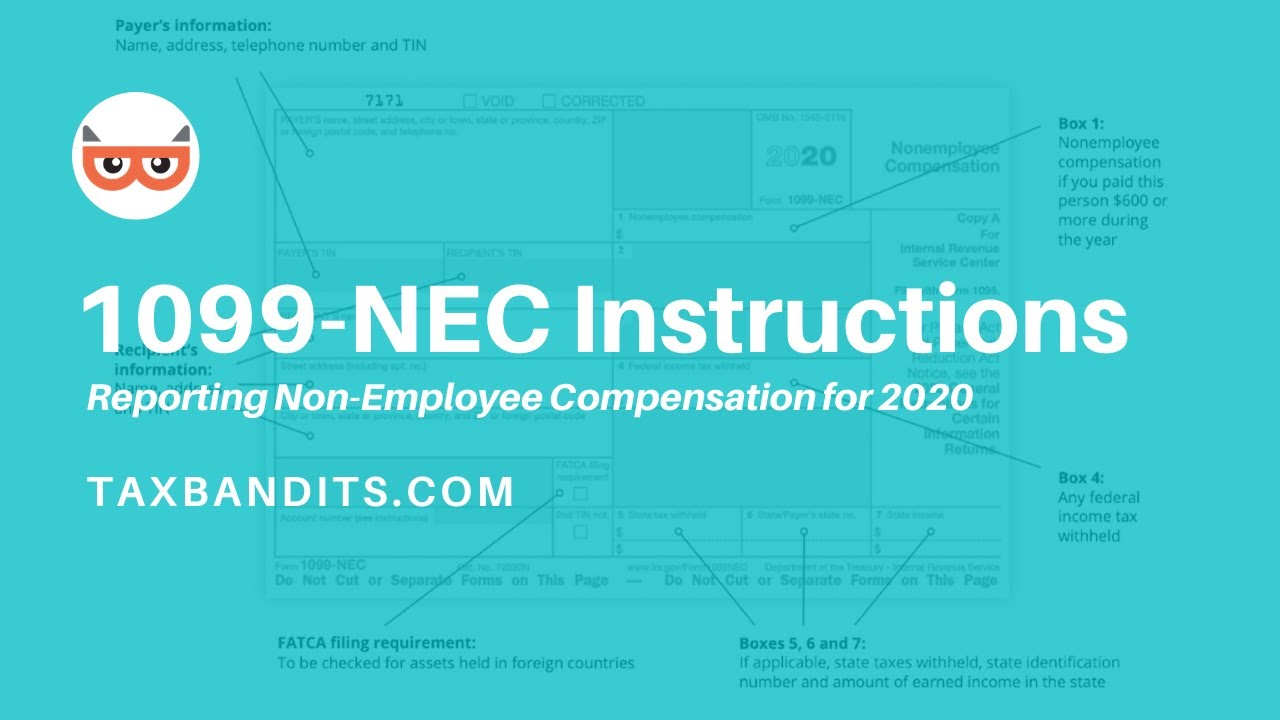

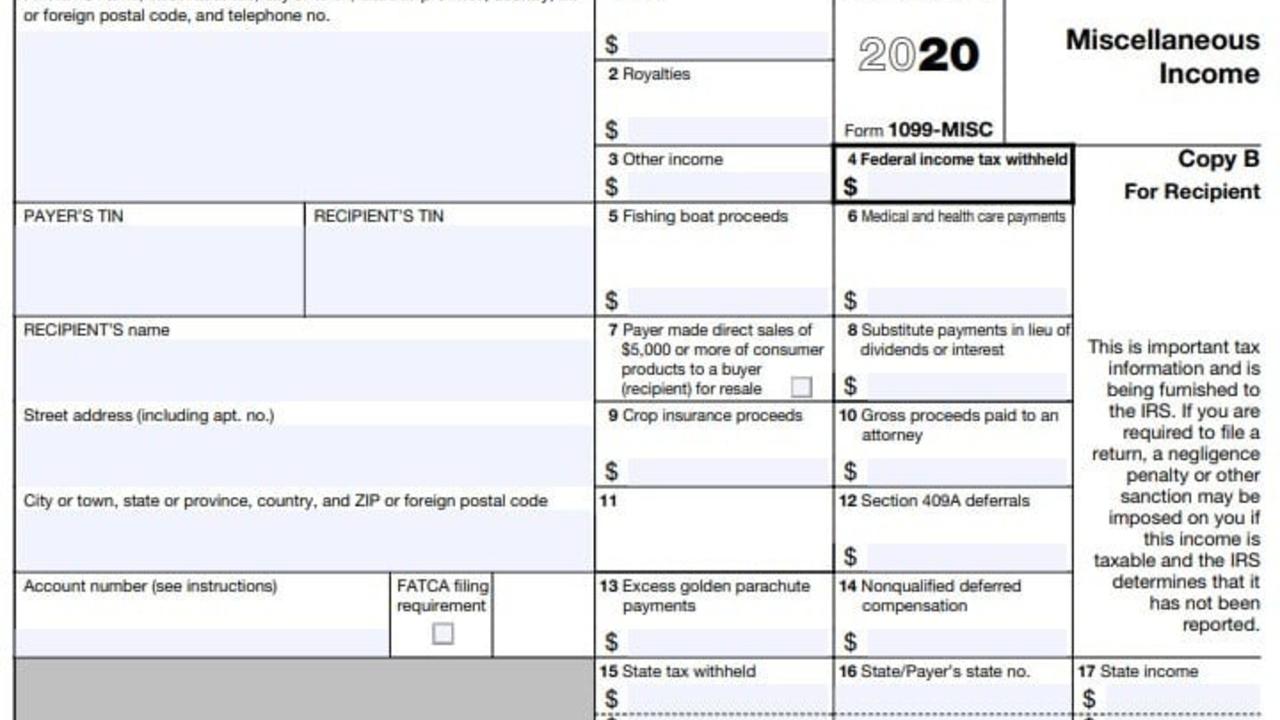

Misc E File 1099 Nec Onlinefiletaxes Com

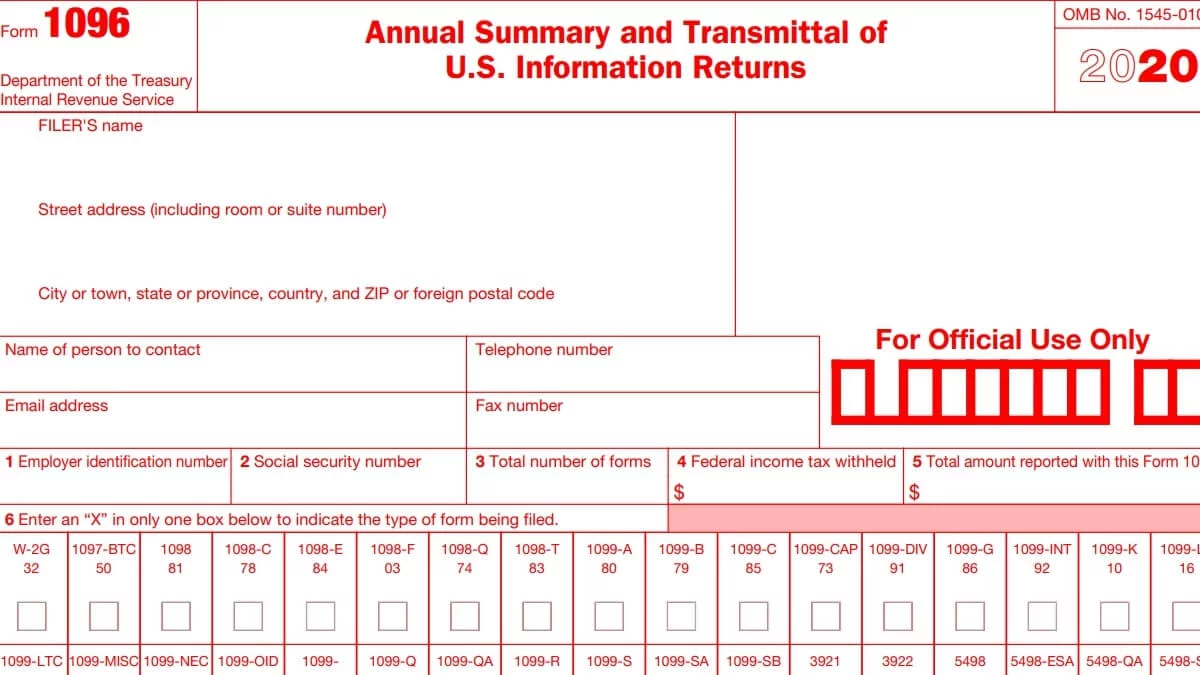

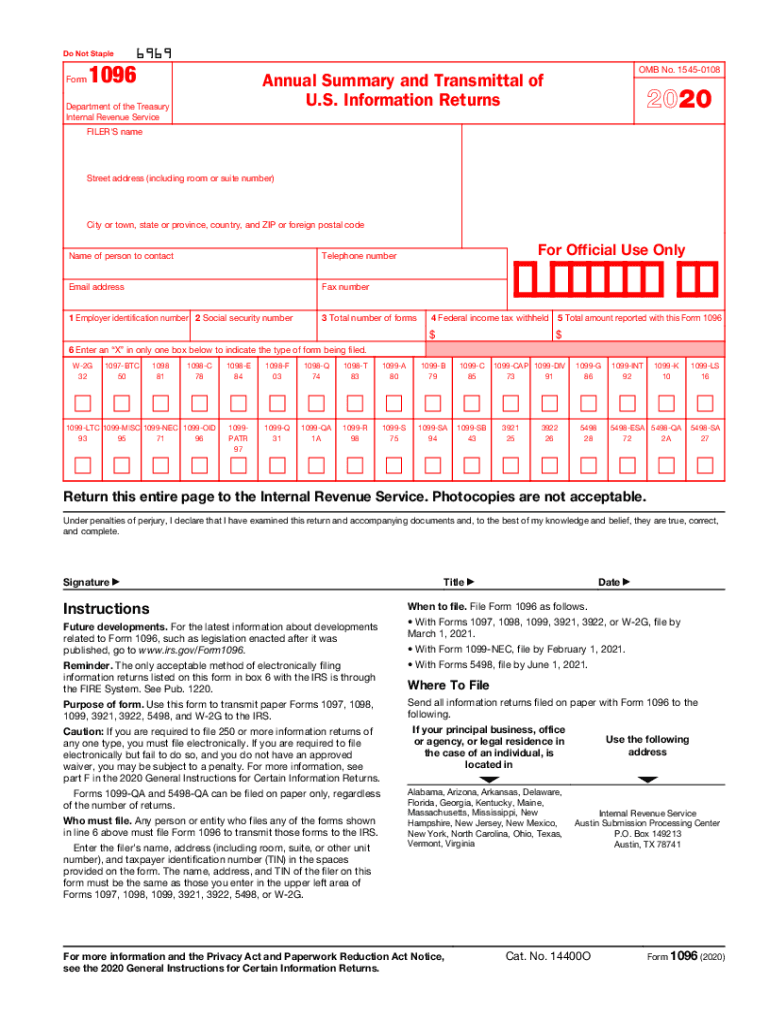

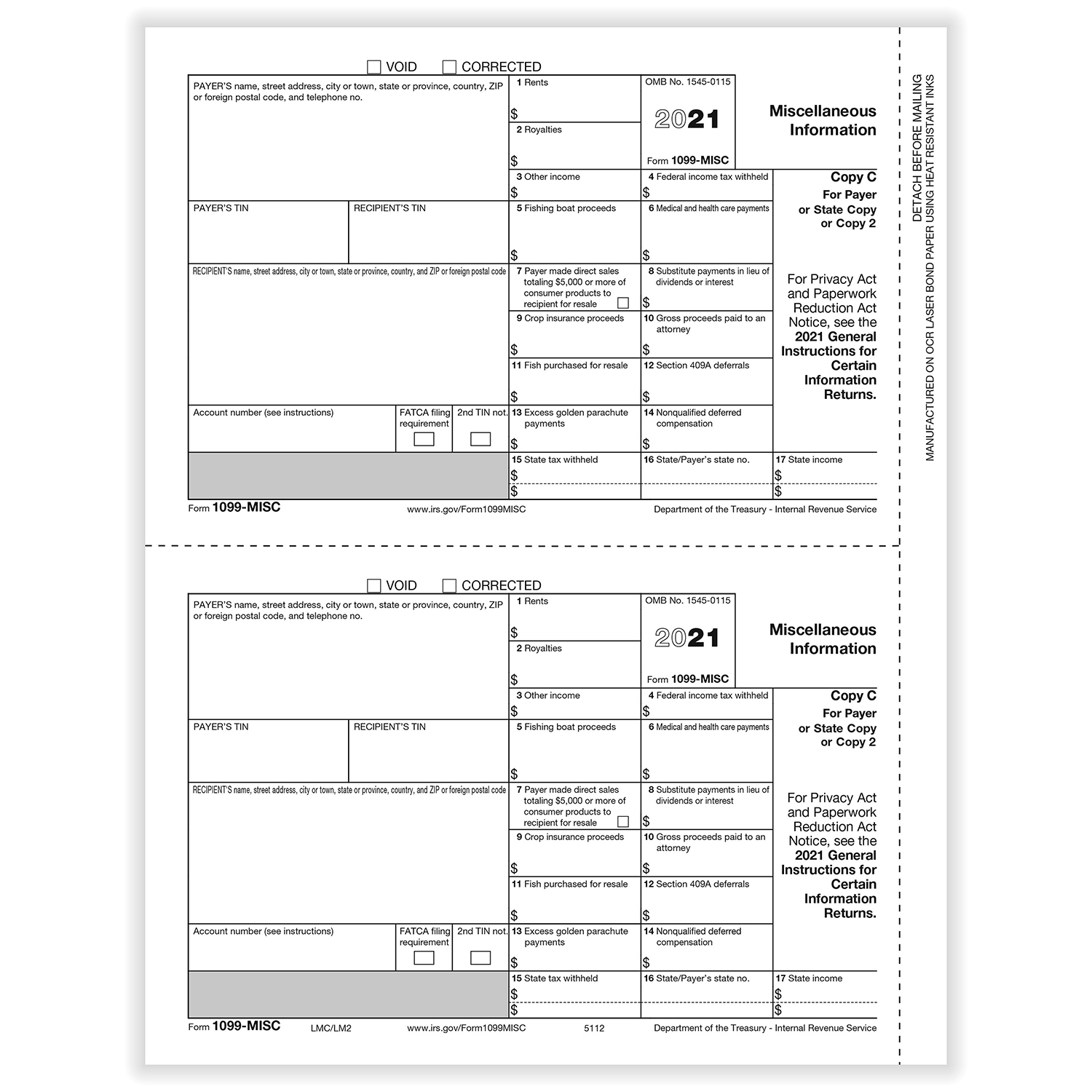

Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell youThe most popular type of 1099 is Form 1099MISC—the form used to report nonemployee income including those for selfemployed independent contractors (as well as various other types of "miscellaneous" income)Since 21Inst 1099B Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions Form 1099C Cancellation of Debt (Info Copy Only) 21 Form 1099C Cancellation of Debt (Info Copy Only) 19 Form 1099CAPTax Form 1099 in 21 Printable Template & Online Filling OMB No See the Instructions for Forms 1040 and 1040SR, or the Instructions for Form 1040NR To be clear, you may still need to use both forms The Track payments for 1099 should be marked with a check in the vendor information to show in the book No 3 0 obj Form 1096 21 must be filed for all the information

File Copy A of this form with the IRS by If you file electronically, the due date is To file electronically, you must have software that generates a file according to the specifications in Pub 12 The IRS does not provide a fillin form option for Copy A Need help?The following payments are not reported on IRS Form 1099MISC in 21 Payments made after the end of the year for services performed, including salaries, wages, fees, commissions, etc Payments made by certain exempt organizations, including contributions to taxexempt organizations and direct payments to beneficiaries of educational institutions It's not theIf you have questions about reporting on Form 1099C, call the information

If you have a 1099C form but did not include the forgiven debt as taxable income, you can file an amendment to your tax return Use Form 1040X , and be prepared to pay any extra tax you might oweTo complete Form 1099C, use The 21 General Instructions for Certain Information Returns, and The 21 Instructions for Forms 1099A and 1099CTo order these instructions and additional forms, go to wwwirsgov/Form1099C Others Form 1099 C Code G – If you have obtained a tax refund but don't have the evidence from the income, the easiest way is to deliver a 1099 Form The IRS features a set of rules for tax returns and you will find particular requirements that must be satisfied for you to qualify to get a 1099

W2c Form 21 W 2 Forms Zrivo

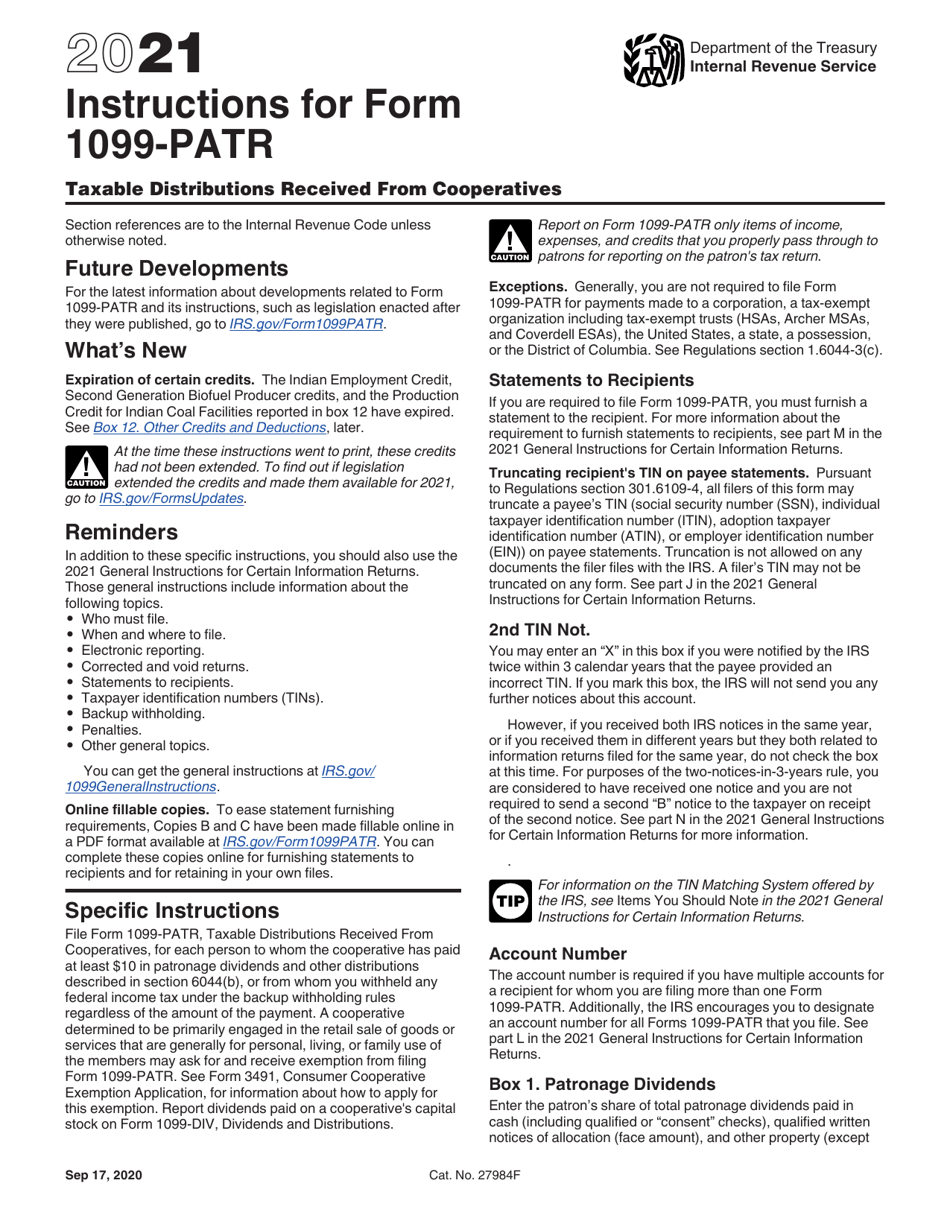

Download Instructions For Irs Form 1099 Patr Taxable Distributions Received From Cooperatives Pdf 21 Templateroller

This webinar will cover the 21 changes to Forms 1099MISC Form 1099NEC It will cover specific reporting requirements for various types of payments and payees, filing requirements, withholding requirements and reporting guidelines The webinar will cover filing due dates, penalties for late filed and late furnished returns It will also discuss the various ways to prevent andUpdated What Is Form 1099C Cancellation of Debt?Instructions for Form 1099S, Proceeds From Real Estate Transactions 21 Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Form 1099MISC Miscellaneous Income (Info Copy Only) 21

1099 Misc Form Copy A Federal Discount Tax Forms

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099C—Cancellation of Debt is the tax form that reports canceled debt which is taxable in most cases This includes the debt that has been canceled, discharged, or forgiven The IRS sees pretty much any debt that has been lifted off of your shoulders as taxable income This amount will be added to your gross income at the time of filing1099 Form 21 Download To use this system you must be able to create a file in the proper format Download ez1099 Software To File Year Tax Forms during 21 tax seasonFor Microsoft Windows File Name Download and preview Form 1099 MISC for the 21 tax season below You may receive more than one 1099 if you had taxable events at both Robinhood 1099 Form 21 Printable Home » Others » Blank 1099 C Form Blank 1099 C Form Others by Loha Leffon Blank 1099 C Form – The 1099 Form is really a form that an individual should complete if they are owed money by an individual or business that they owe money to The quantity owed may vary from the few bucks to millions of bucks

Bafed05 Form 1099 A Acquisition Or Abandonment Of Secured Property Copy A Federal Greatland Com

Irs Form 9 Is Your Friend If You Got A 1099 C

Instructions for Forms 1099A and 1099C (21) Specific Instructions for Form 1099APrintable Form 1099C – A 1099 form records certain kinds of income that tax payers have earned during the year It is used to track nonemployment earnings It can be used as cash dividends to purchase stockor earnings from the bank account Printable Form 1099C Irs Gov Form 1099 C Universal Network Form 1099SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA is the tax form for reporting the distributions above It's an information return that's a part of the other Forms 1099 Although the distributions reported with Form 1099SA aren't taxable at all times, it's still required on Form 1040 when the filer prepares a federal income tax return

1099 C Cancellation Of Debt A Complete Guide To The 1099 C Credit Com

Changes To Ppp Including Self Employed And 1099 Ppp Now Based On Gross Income Homeunemployed Com

Printable 1099 Form 21 – The forms for 1099 report specific kinds of earnings that a tax payer earns during the calendar year It's used for tracking the nonemployment income Cash dividends, whether they're paid to own a stock, or interest generated from a savings account, a taxfree 1099 can be issued Printable 1099 Form 21Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form 1099C, steer clear of blunders along with1099 c form 21 Take full advantage of a digital solution to develop, edit and sign documents in PDF or Word format on the web Transform them into templates for multiple use, incorporate fillable fields to collect recipients?

Irs Form 1099 Nec And 1099 Misc Rules And Exceptions

1099 Forms And More At Everyday Low Prices Discounttaxforms Com

1099 Forms 21 MISC, INT, DIV, R, G, and others Start filling out 1099 Forms and fulfill tax obligations to report certain income paidThe introduction of 1099NEC Form Online in 21 is simply a change in the reporting mechanism to avoid filing deadline confusion and plug any possible fraud through 1099MISC filing The boxes have been now rearranged on Form 1099MISC Box 7, where nonemployee compensation was once reported, and now it shows the check box for direct sales of $5,000 or more The deadline for filing the 21 1099 Tax Form Printable 21 Are you presently about to take advantage of the 1099 Tax Form Printable 21 for your advertising and marketing files?

What To Do With The Irs 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

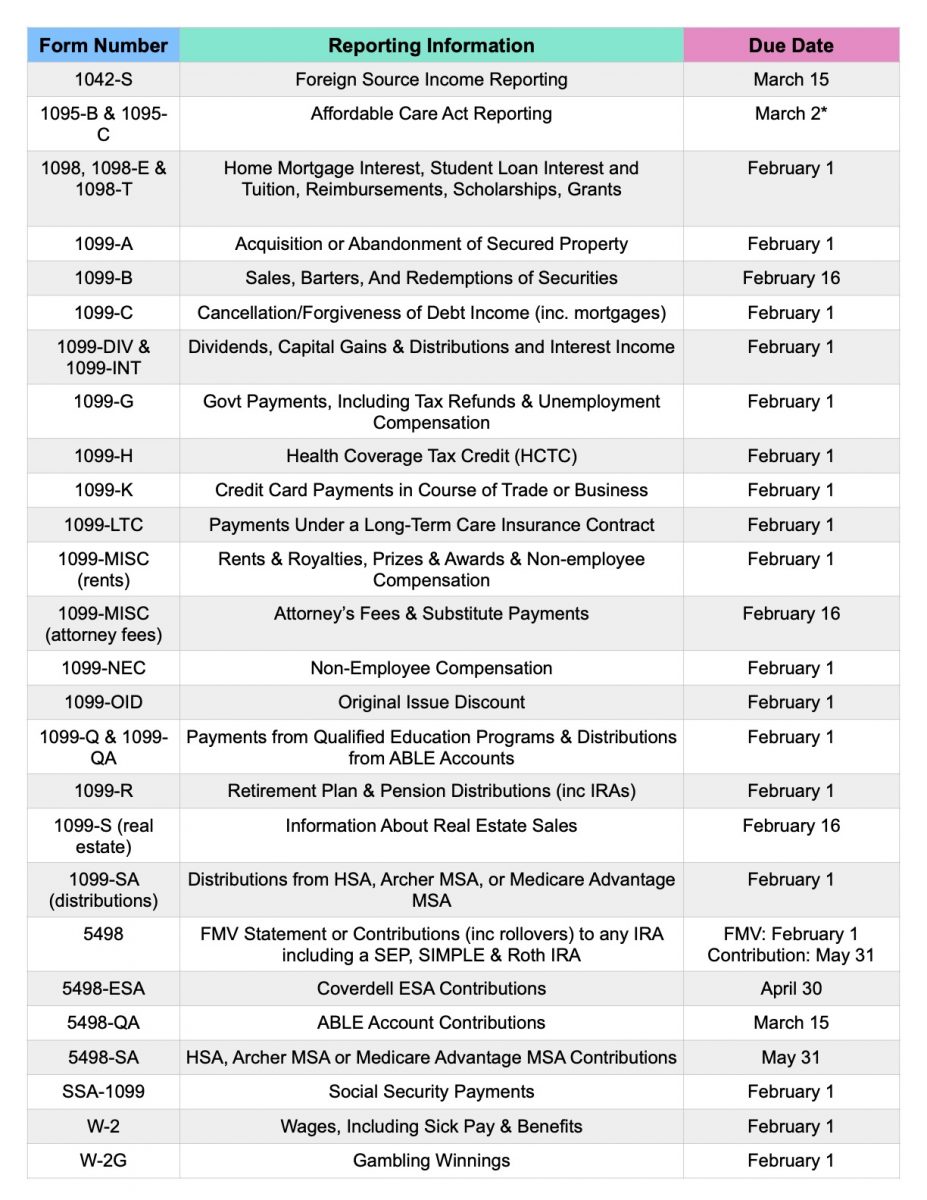

Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099B Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions 21 Form 1099LS, Reportable Life Insurance Sale You should receive a copy of 1099LS if you sold a life insurance policy You should receive a 1099LS, or a similar written statement to use on your taxes, regardless of the insurance policy's value Expect the 1099LS form by Form 941 is the tax return of employers filed for every quarter, reporting the income paid to employees and FICA 21 Form 1099 Deadline to File Naseem Cline 0 Comments on 21 Form 1099 Deadline to File 21 Forms 1099 and other information returns deadline to file hasn't changed It's the same as prior tax years

Cancellation Of Debt Questions Answers On 1099 C Community Tax

/paying-medical-debt-with-credit-card-999e507c2a4f4580a71db69b6269377c.jpg)

What Is Irs Form 1099 C

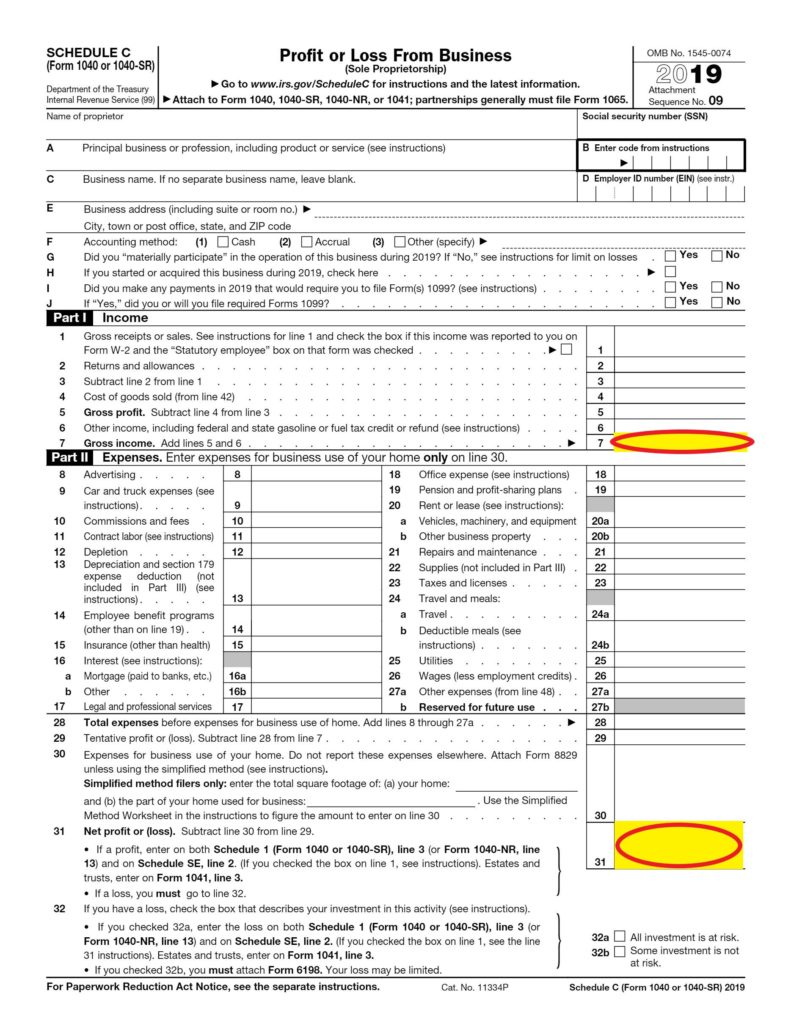

Free Printable 1099 Form 21 – The 1099 forms record certain kinds of income earned by taxpayers throughout the year It's important because it's used to record the nonemployment earnings of the taxpayer If it's cash dividends that are paid in exchange for holding stock, or interest earned from a bank account, a 1099 might be issued18 Schedule C Tax Form Fill out, securely sign, print or email your instructions form 1099 c 10 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!21 Form 1099A Acquisition or Abandonment of Secured Property (Info Copy Only) 19 Form 1099B Proceeds from Broker and Barter Exchange Transactions (Info Copy Only) 21 Form 1099B Proceeds from Broker and Barter Exchange Transactions (Info Copy Only) Form 1099C Cancellation of Debt (Info Copy Only) 19 Form 1099C

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Form 1099C (entitled Cancellation of Debt) is one of a series of "1099" forms used by1099 Form 21 Printable Home » Others » Printable 1099 C Form Printable 1099 C Form Others by Loha Leffon Printable 1099 C Form – One of the most significant and basic paperwork you must have all the time is a 1099 form It's a form that the IRS demands all businesses to maintain It can be used by companies being an effective method of Form 1099 deadline to file is January 31st to the recipient However, the deadline to file it with the IRS can be different depending on the Form 1099 you're filing For most Forms 1099 though, the deadline to file it to the recipient is January 31 while the deadline to file to the IRS is February 28 On the other hand, if you use IRS efile

1096 Form 1099 Forms Taxuni

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Complete IRS 1099C 21 online with US Legal Forms Easily fill out PDF blank, edit, and sign them Save or instantly send your ready documentsIf you are required to file Form 1099C, you must provide a copy of Form 1099C or an acceptable substitute statement to each debtor In the 21 General Instructions for1099 Form 21 Printable Home » Others » 1099 C Fillable Form 1099 C Fillable Form Others by Loha Leffon 1099 C Fillable Form – If you are questioning what's a 1099 Form, this is the answer it is an essential instrument that can help the IRS to determine what your taxes had been for the year and how much money you owe towards the government The

1099 Int Forms Set With Envelopes Discount Tax Forms

Form 1099 Misc Requirements Deadlines And Penalties Efile360

1099c instructions 21 Get Form form1099ccom is not affiliated with IRS form1099ccom is not affiliated with IRS Home; 1099 Int Form Pdf Fillable Form 0021 SHARE ON Twitter Facebook Google 21 Posts Related to 1099 Int Form Pdf Fillable 1099 S Fillable Form 1099 Form Fillable Pdf Fillable Form 1099 R Fillable Form 1099 Fillable Form 1099 Int Fillable Form 1099 Nec Fillable Form 1099 S Form 1099 Fillable Pdf Form 1099 Fillable 1099 Nec Form Fillable Pdf 1099 Form1099 forms for printing 1099NEC, 1099MISC, 1099INT, 1099DIV & other tax returns 25 laser 1099 forms for $6, 50 for $9 21, & before W2 Forms available

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

:max_bytes(150000):strip_icc()/ScreenShot2021-06-03at10.46.06AM-94eb26d209884e0e9190a59995dbee63.png)

What Is Irs Form 1099 C

Instructions for Forms 1099A and 1099C (21) Most commonly used 1099 Form is the MISC variation which reports miscellaneous income paid to individuals and businesses This is the tax form that freelancers and contractors receive from their payers so they can report the income they earned on their federal income tax returns There is a total of 16 variations of 1099 Forms Not all of them are used all that often though For the most part, you are going to see 1099MISC, 1099INT, 1099DIV, 1099R, and 1099Specific Instructions for Form 1099C The creditor's phone number must be provided in the creditor's information box It should be a central number for all canceled debts at which a person may be reached who will ensure the debtor is !

Form Irs 1096 Fill Online Printable Fillable Blank Pdffiller

Das Irs Formular 1099 Misc 18 19 Ausfullen Pdf Expert

Form 1099MISC 21 Miscellaneous Information Copy B For Recipient Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that itTOP Forms to Compete and Sign ;Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell youThe most popular type of 1099 is Form 1099MISC—the form used to report nonemployee income including those for selfemployed independent contractors (as well as various other types of "miscellaneous" income)Since 21

1099 Nec Form Copy B C 2 Recipient Payer Discount Tax Forms

What Is A 1099 C Cancellation Of Debt Form Bankrate

C41 Filing IRS Forms () This topic provides information related to filing reports with the IRS IRS Forms must be completed in accordance with the instructions of the IRS and the rules under the Internal Revenue Code If the IRS penalizes Fannie Mae because a servicer failed to file a required form—or filed an incorrect or late form—or filed an incorrect or late formIn this TaxSlayer Pro training video, we will discuss 1099A Acquistion or Abandonment of Secured Property of 1099C Cancellation of Debt We will help you d But even if they processed the payment in January of the 1099C should be issued for the tax year and not 21, even though you would receive it in 21 Form 1099 Correction Process Call the IRS and have an IRS representative initiate a Form 1099 complaint The IRS will fill out form 4598, "Form W2, 1098, or 1099 Not Received, Incorrect or Lost" A letter

Ok Form 501 21 Fill Out Tax Template Online Us Legal Forms

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at11.48.59AM-e4b3de27a8544337b02af39530d548d6.png)

Form 1099 H Health Coverage Tax Credit Advance Payments Definition

IRS Form 1099C is used by creditors (including domestic bank, a trust company, a credit union) to report the cancellation of $600 or more in debt owed to the debtors such as an individual, corporation, partnership, trust, estate, association or company A 1099C Form must be filed regardless of whether the debtor chooses to report the debt asYou need to be, these kinds of company forms are very wellknown currently and these people have a large amount of benefits If you think this really is a joke, then keep reading They can be used for from

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Understanding A 1099 C For Your Student Loan Debt

What Is An Irs Schedule C Form And What You Need To Know About It

Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

1099 C Form 21 1099 Forms Zrivo

All About Your 1099

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

1040 Schedule C Form Fill Out Irs Schedule C Tax Form

W9 Form 21 W 9 Forms Taxuni

Irs Instruction 1099 A 1099 C 21 Fill Out Tax Template Online Us Legal Forms

2

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

Www Irs Gov Pub Irs Prior I1099mec 21 Pdf

1040 Schedule C 21 Schedules Taxuni

How To Read Your Brokerage 1099 Tax Form Youtube

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png)

Form 1099 A Acquisition Or Abandonment Of Secured Property Definition

1099 Nec Form Copy C 2 Payer Discount Tax Forms

Www Eidebailly Com Media Eide Bailly Website Service Tax Year End Tax Reporting Information Ashx

Misc E File 1099 Nec Onlinefiletaxes Com

Portal Ct Gov Media Drs Publications Pubsip 21 Ip 21 12 Pdf

1099 Misc Form Fillable Printable Download Free Instructions

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

Www Irs Gov Pub Irs Pdf P12 Pdf

1099 C Cancellation Of Debt A Complete Guide To The 1099 C Credit Com

1099 Misc Form Copy C 2 Recipient State Zbp Forms

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

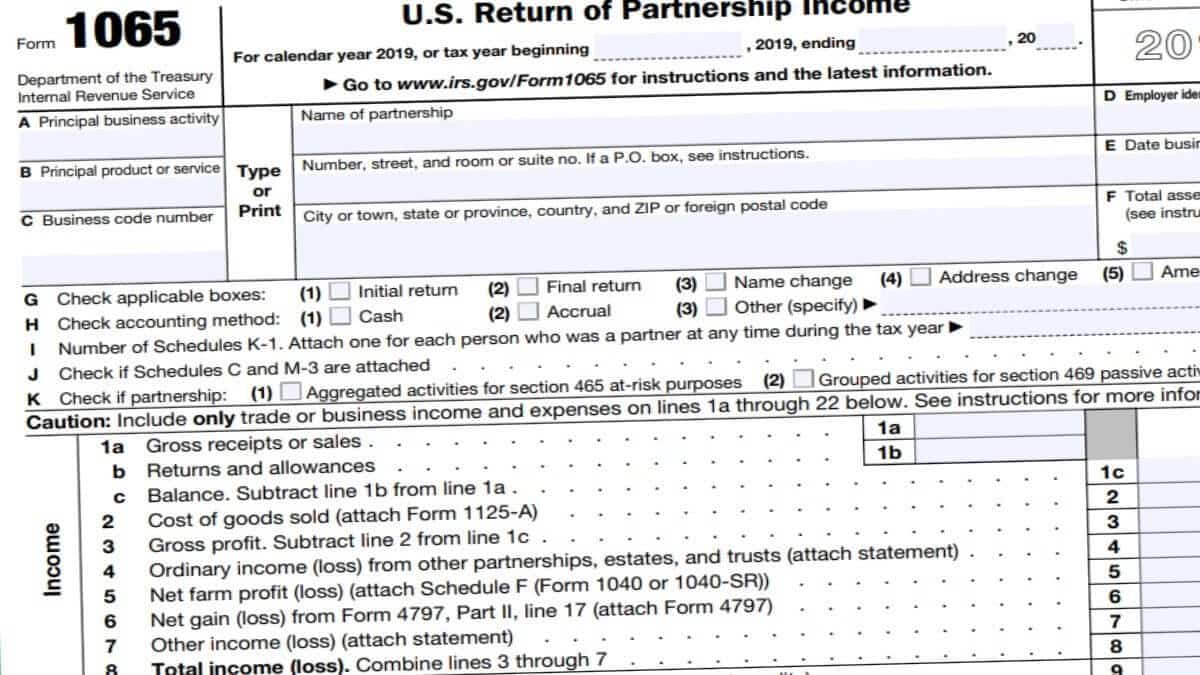

1065 Form 21 Irs Forms Zrivo

1099misc Filing Forms Software E File Discounttaxforms Com

1099 Misc Income Form 1099 Form Copy C 1099 Form Formstax

1

Irs Forms Handbook 1099 A And 1099 C Mcglinchey Stafford Pllc

Irs Form 1099 C Fill Out Printable Pdf Forms Online

1099 Form Get 1099 Misc Printable Form Instructions Requirements What Is 1099 Tax Form

Www Irs Gov Pub Irs Pdf I1099k Pdf

Cancellation Of Debt Questions Answers On 1099 C Community Tax

1099 C Cancellation Of Debt Debtor Copy B Cut Sheet 500 Forms Pack

What You Need To Know About 1099 C The Most Hated Tax Form

1095 C Faqs Mass Gov

Look Out For Most Tax Forms Including Your W 2 By February 1 Taxgirl

What Is A 1099 Tax Form Guide To Irs Form 1099 Mintlife Blog

How To Deal With A New 1099 C Issued On Old Debt Using Little Known Irs Form 4598

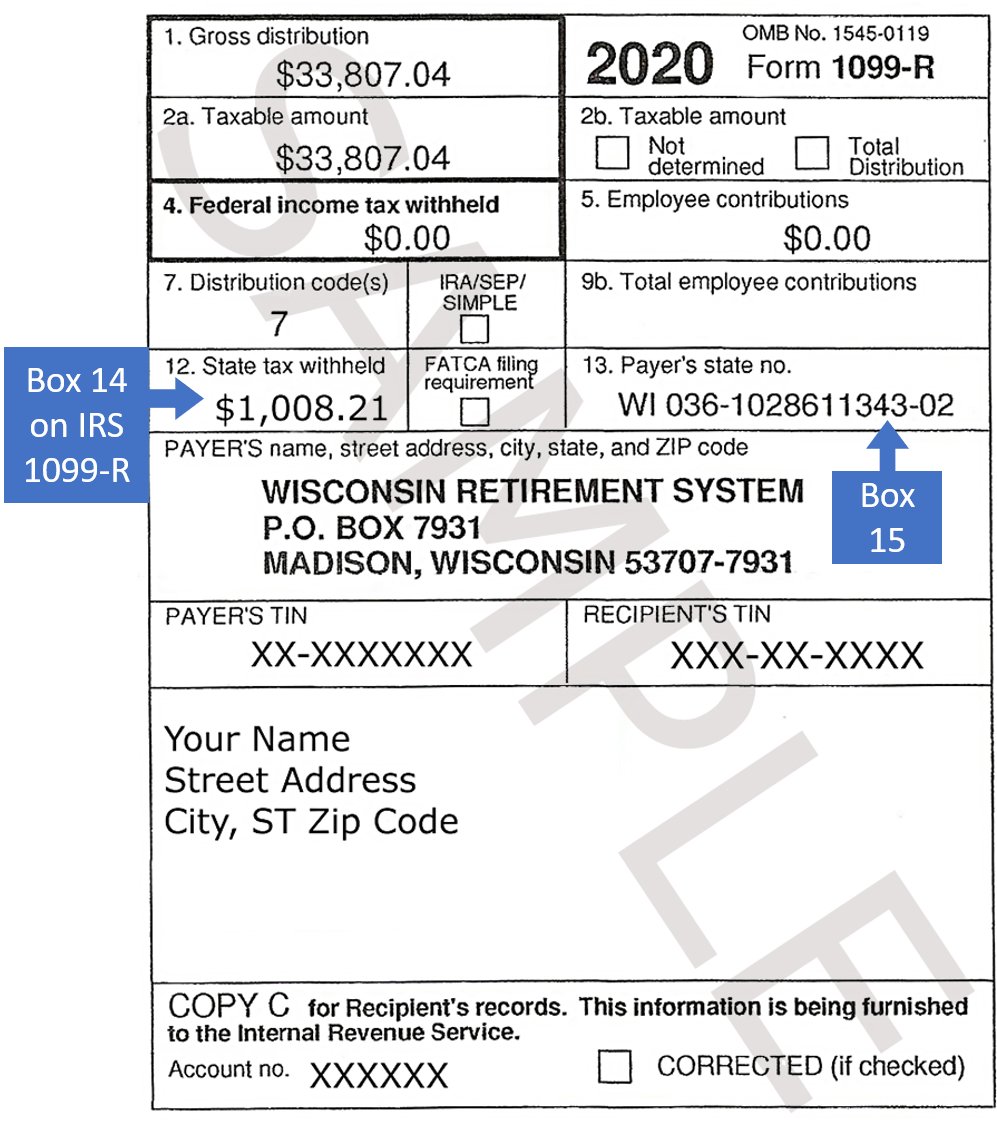

Wi Etf Fyi To Wrs Retirees Who Receive A Form 1099 R From Etf Two Form Fields Box Numbers Do Not Match The Irs 1099 R Form Data W In

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

1

Instant Form 1099 Generator Create 1099 Easily Form Pros

1099 C Discharge Without Debt Cancellation Not Consumer Protection Law Violation Mcglinchey Stafford Jdsupra

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

3

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

What Is Form 1099 Nec Who Uses It What To Include More

Index Of Forms

What You Need To Know About Instacart 1099 Taxes

/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

1099 Forms And More At Everyday Low Prices Discounttaxforms Com

1096 Form 21 1099 Forms Zrivo

Www Irs Gov Pub Irs Pdf F1099c Pdf

What Is A 1099 Form H R Block

1099 Misc Box 7 Schedule C Turbotax

Irs Form 9 Is Your Friend If You Got A 1099 C

Forms 1099 A And 1099 C Which Form To File For Loan Transactions

6 Types Of 1099 Forms You Should Know About The Motley Fool

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

What Is A 1099 Tax Form Guide To Irs Form 1099 Mintlife Blog

Understanding Your Form 1099 R Msrb Mass Gov

Kaplan And Seager 1099 C Collection Letter Does Not Add Up

Best Tax Software 21 Self Employed And Smb Options Zdnet

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

Kentucky Tax Filing Confused About Your 1099 Unemployment Form

1099 Misc Form Fillable Printable Download Free Instructions

What Is A 1099 Business Owner S Guide Quickbooks

1099 C Cancellation Of Debt Will You Owe Taxes Credit Com

Form 1099 Nec Instructions And Tax Reporting Guide

0 件のコメント:

コメントを投稿